Increased Requirements - European Union (EU) is strengthening safety and security

The European Union (EU) is strengthening safety and security at customs through a large-scale information system called Import Control System 2 (ICS2), and we will need to provide additional information about your shipments to the authorities. Due to this, we are asking you to ensure you provide these details, each time you ship.

1. A minimum six-digit Harmonised System (HS) code

You should be able to find the correct codes for your items on your country’s government website.

https://www.newzealandchambers.co.nz/export-documentation/hs-codes/

A Harmonised System (HS) code is an internationally standardised system of describing and classifying goods. It is used by customs authorities to identify items and apply the correct duties and taxes (or restrictions) to them. In some countries, HS codes are also known by other names. Tariff codes and commodity codes are two of the most common

2. Provide a full and accurate goods description

This is needed for each type of item you are shipping. The description should answer:

- What is it?

- What is it made of?

- What is it intended for?

Remember to also include the material composition breakdown – e.g. a men’s suit might be 80% cotton and 20% polyester – and check if you require any additional paperwork.

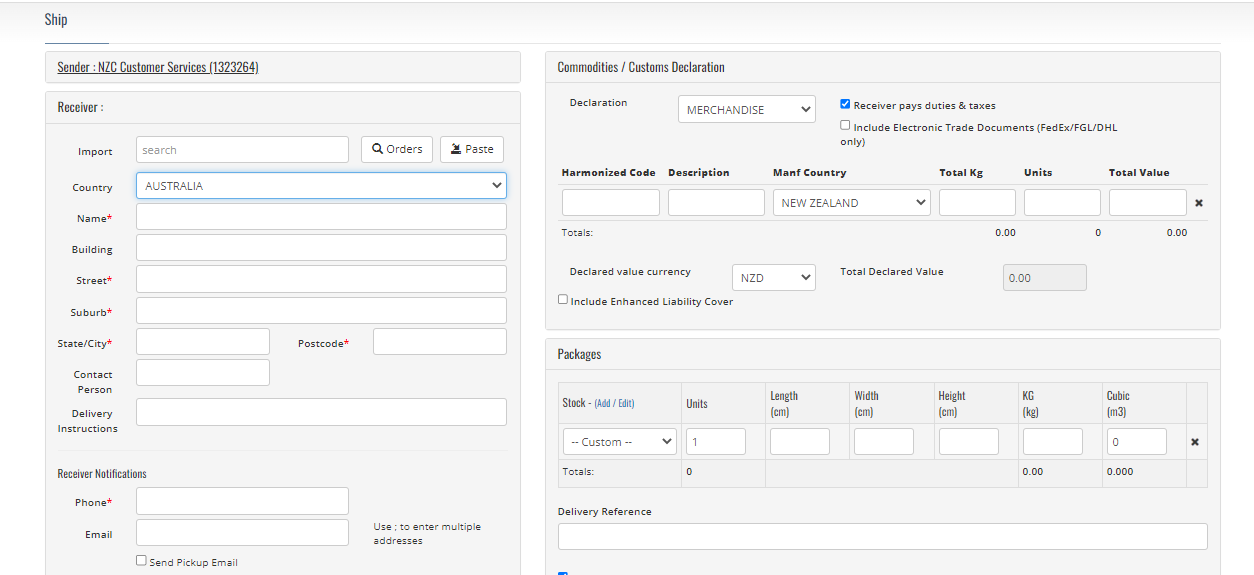

3. Provide this information in the correct places

The HS codes and goods descriptions should be added in the dedicated field of your shipping application (which will then populate the air waybill), as well as on the commercial invoice. Only supply this information on the commercial invoice is likely to lead to delays in transporting or delivering your goods. If you are unsure of how to enter this information, please contact your sales representative.

In GSS:

- Add the EORI number to the Receiver field (Delivery instructions)

AND - include the EORI number in the Description field

That will ensure it’s printed on the Commercial Invoice.

4. Include your receiver's EORI number

You will need to include your receiver’s Economic Operator Registration and Identification (EORI) number on the commercial invoice of your shipping application when you ship to a business recipient in the EU** or Northern Ireland and Switzerland.

Click here for more background information.